Stop Saving.

Start Compounding.

Build a passive wealth engine with India's most stable asset class. Earn monthly rentals & long-term appreciation, without the operational headaches.

Strategy of the Top 1%.

Real Estate Investing is broken in India

In February 2026, investing should be simpler.

Real Estate is hard to navigate

Critical market data is siloed and legal frameworks are convoluted. Accessing high-quality deals often relies on privileged, offline networks rather than transparent metrics.

Prohibitive Capital Intensity

Premium assets demand multi-crore commitments. This forces investors to concentrate heavy capital into a single asset, preventing proper portfolio diversification.

Misaligned Incentives

Traditional transactions are driven by commission structures of middlemen rather than asset performance. This creates a fundamental conflict of interest where recommendations prioritize the sale over the investor's long-term returns.

The Post-Investment Black Box

Traditional real estate offers zero feedback loops. Investors are left with fragmented, retrospective updates on tenant stability and operational costs, making it impossible to actively monitor portfolio health.

Getting started with real estate was never this simple

Real estate has always been where wealth gets built in India.

Accessible Quality Assets

Bypass the multi-crore requirement. Acquire fractional ownership in premium assets starting at ₹10,00,000.

Digital Execution

Eliminate paperwork. Complete 100% digital KYC and execute legal agreements in minutes.

Performance Visibility

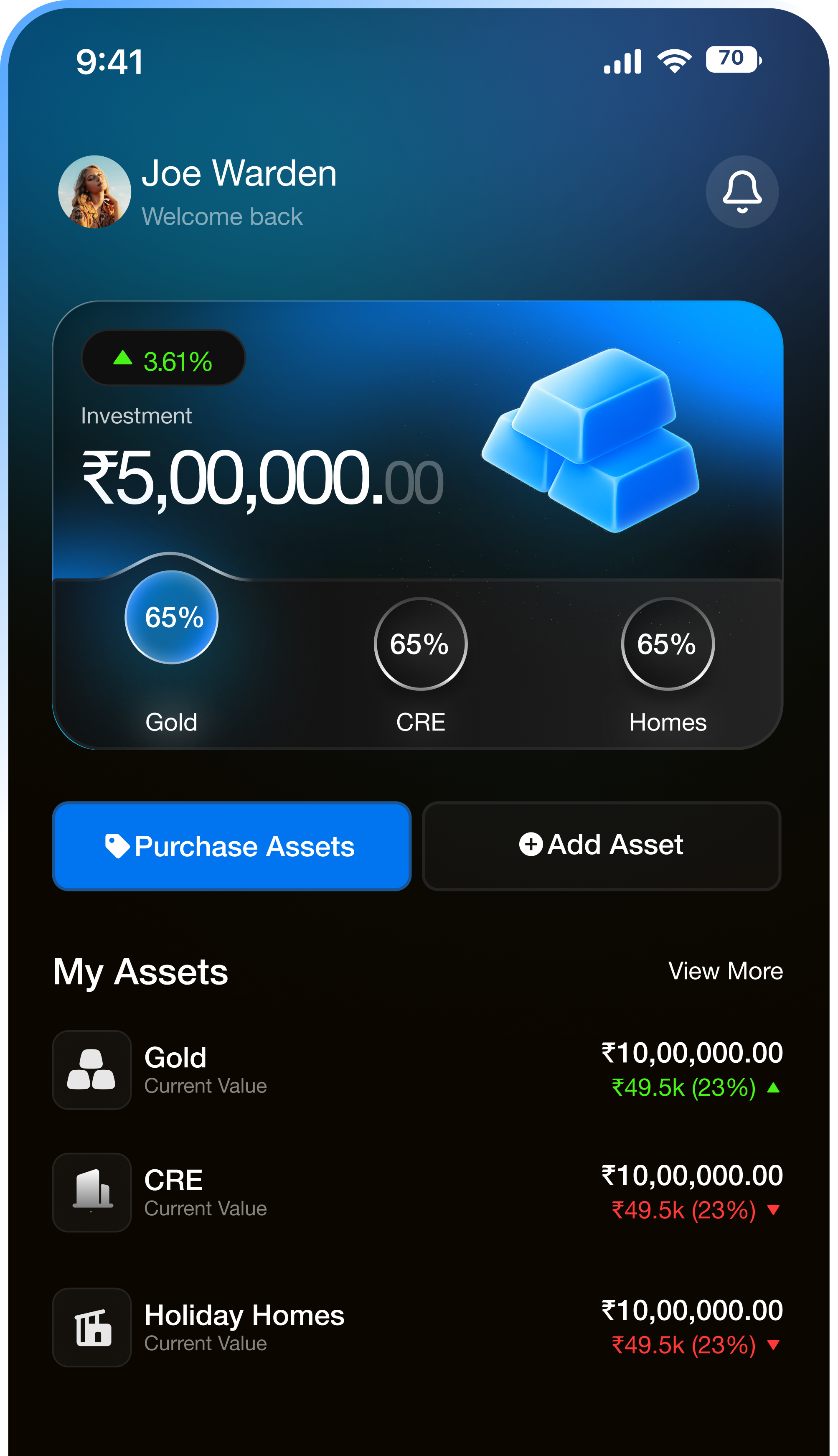

No more guessing. Monitor rental yields, dividends, and capital appreciation on a real-time dashboard.

Regulatory Governance

Invest with security. Structured on rigorous frameworks with independent oversight.

Real Estate Investing, Made Simple.

Own premium properties and grow your wealth through rental income and appreciation, starting from just ₹10,00,000.

The Old Way

Prohibitive Capital Barriers

Requires concentrated capital commitments of ₹10 Cr+.

Analog & Fragmented

Manual documentation with extended closing cycles.

Information Asymmetry

Opaque reporting with lagging performance indicators.

Misaligned Incentives

Transaction-driven processes reliant on intermediaries.

The Finplify Way

Optimized Ticket Sizes

Intelligent diversification starting from ₹10,00,000.

Digital Execution

Seamless, 100% paperless onboarding & compliance.

Real-Time Governance

Live tracking of rental yields, occupancy, and NAV.

Institutional Oversight

SEBI-compliant structure with independent trusteeship.

Engineered for Yield. Managed for Growth.

From acquisition to exit, we handle the entire asset lifecycle so your capital remains truly passive.

Become a Property Owner in Minutes, Not Months.

We've replaced the paperwork, brokers, and waiting periods with a simple 4-step digital flow.

High-Grade Deal Flow

Invest in premium, pre-leased commercial, hospitality assets, and spaces occupied by top-tier MNCs & banks.

Asset Lifecycle Management

True passive income means zero operational headaches. We handle everything: tenant sourcing, lease renewals, facility maintenance, and rent collection.

Quantitative Strategy

We eliminate speculation. Our Investment Committee utilizes deep macro-economic data and micro-market trends to validate every potential acquisition.

Institutional Reporting

Transparency is our currency. Track your rental yields, capital appreciation, and dividend payouts in real-time.

See How Small Steps Grow Into Lifelong Wealth

Real stories. Real portfolios. Real people who started small and built something meaningful.

Priya Sharma

First Time Investor

Being a first-time investor, I was initially hesitant about where to start. That's when I stumbled upon Finplify, and it turned out to be a game-changer for me. The platform's easy-to-understand investment options in traditional assets gave me the confidence to take the plunge. What impressed me the most was the personalized support I received from their team.

Stop Saving. Start Owning.

I'm ready to build my portfolio

Access exclusive, high-yield opportunities before they sell out. View full due diligence reports and invest in minutes.

I need strategy first

Unsure where to start? Speak to a Wealth Manager to understand how fractional ownership fits your financial goals.

Digital Partners